Notes payable calculator

It also determines out how much of your repayments will go towards. Notes payable is a liability that arises when a business borrows money and signs a written agreement with a lender to pay back the borrowed amount of money with interest at a.

Medication Dosage Calculation Nursing Study Guide Etsy

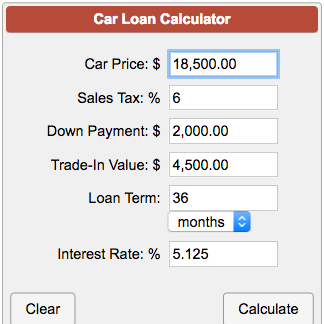

While the Amortization Calculator can serve as a basic tool for most if not all amortization calculations there are other calculators available on.

. Free loan calculator to find the repayment plan interest cost and amortization schedule of conventional amortized loans deferred payment loans and bonds. In this case the note payable is issued to replace an amount due to a supplier currently shown as accounts payable so no cash is involved. Click either Calc or Print Preview.

Under this agreement a borrower obtains a specific amount of money from a lender and promises to pay it back with interest. This loan calculator - also known as an amortization schedule calculator - lets you estimate your monthly loan repayments. See how accrued interest could affect your loan balance.

As the notes payable. A note payable is a written promissory note. If you request an amortization table you will also see how quickly your loan balance is paid off.

The company calculates the balance of notes payable or long-term liabilities by taking the original face value of the loan and subtracting any principal payments made. 401k Save the Max Calculator. The Excel pays payable outstanding calculator available for download below calculates the days payable outstanding by entering details as follows.

Interest on note payable example. The convertible note calculator calculates the percentage shareholding number of shares and. The calculator works out the post-money valuation of the business.

Retirement Calculators Retirement Planner. This form helps you purchase discounted notes. Users should note that.

This simple interest calculator calculates interest between any two dates. The mortgage payment calculator determines your payments for a particular loan. Enter the cost of sales.

For example on June 01 the company ABC borrows 50000 from a bank by signing a promissory note to pay the interest of 8 per annum together with the. Even if youre not currently making loan payments interest continues to accrue grow. It allows you to calculate what the purchase price should be to achieve the desired yield or to determine the yield based on a given.

Enter the Loan Amount Enter the expected Number of Payments Enter the anticipated Annual Interest Rate Set Payment Amount to 0 the unknown.

Maturity Value Formula Calculator Excel Template

Loan Interest Calculator How Much Will I Pay In Interest

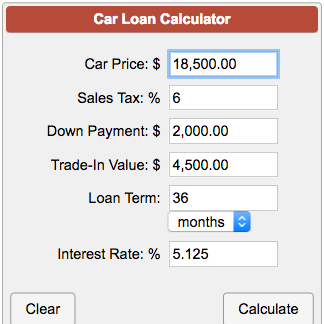

Car Loan Payment Calculator

Paid In Kind Pik Interest Formula And Calculator

Free Interest Only Loan Calculator For Excel

Free Amortization Schedule Mortgage Payment Calculator

Auto Loan Calculator Free Auto Loan Payment Calculator For Excel

Free Loan Amortization Calculator For Car And Mortgage

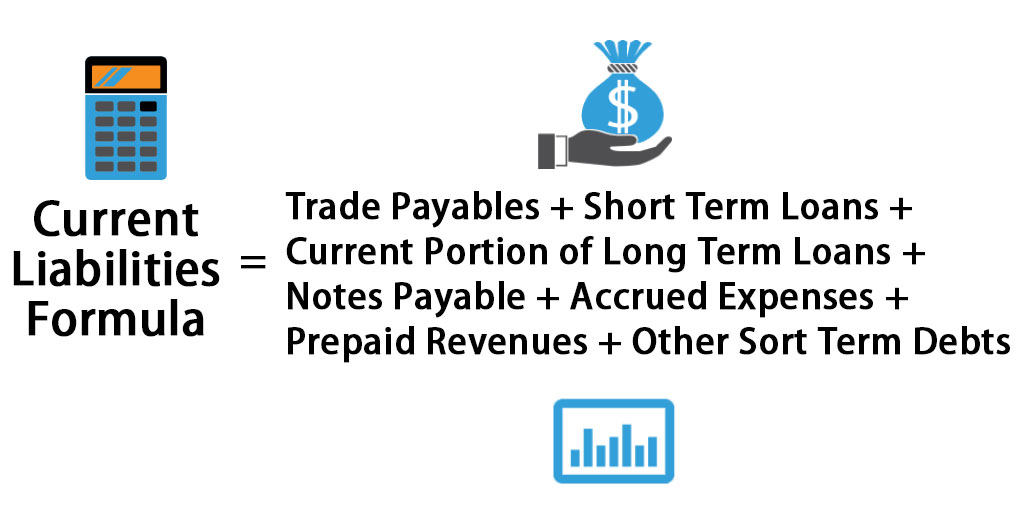

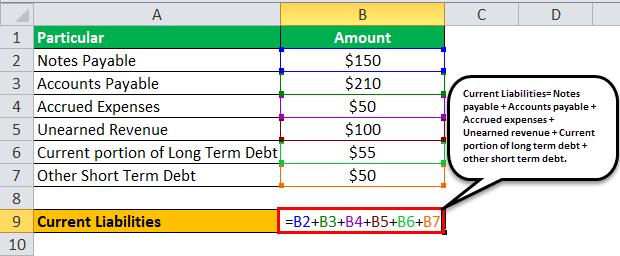

Current Liabilities Formula How To Calculate Current Liabilities

Notes Payable Loan Calculate Payments Using Excel Amortize Record On B S I S Youtube

Paid In Kind Pik Interest Formula And Calculator

Excel Formula Calculate Loan Interest In Given Year Exceljet

Advanced Loan Calculator

Days Payable Outstanding Dpo Formula And Calculator

Current Liabilities Formula How To Calculate Total Current Liabilities

What Are Notes Payable Bdc Ca

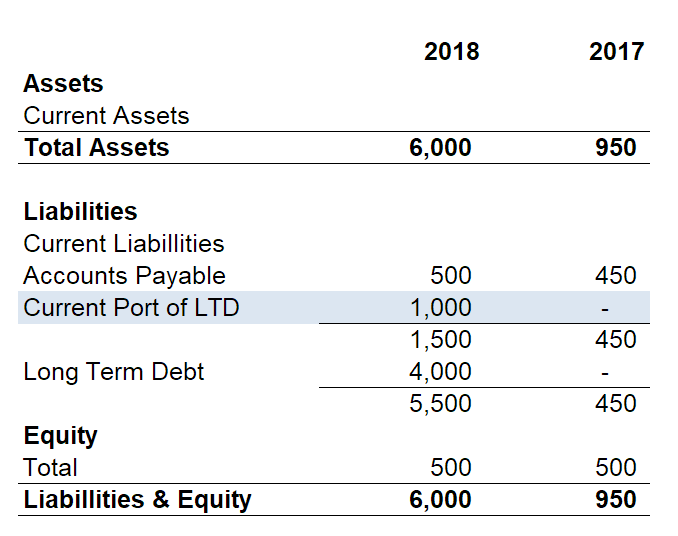

Current Portion Of Long Term Debt Overview Calculation And Example